By incorporating real-time artificial intelligence into market observation, Summit Finthor clarifies cryptocurrency trading. The platform continuously analyzes up-to-date data, generating quick assessments and insightful analyses to help make informed decisions quickly.

Summit Finthor utilizes machine learning to analyze complex behavioral patterns and monitor real-time market trends. Instead of depending on out-of-date sources or subjective opinions, users receive data-backed signals that accurately reflect the current situation. These realizations aid in the development of more methodical tactics.

Additionally, Summit Finthor features a copy trading option that allows users to replicate successful trading strategies. Through its risk-aware structure, user-friendly interface, and secure layout, Summit Finthor encourages accessible trading.

Summit Finthor offers AI-powered market monitoring solutions that can adjust to shifting market conditions. In order to detect movement patterns in real time, it uses a responsive analysis engine.

Summit Finthor provides AI-powered market monitoring solutions that can adapt to changing market conditions. To detect movement patterns in real-time, it utilizes a responsive analysis engine. AI Intelligence for Better Trading Decisions Summit Finthor

Real-time AI analysis from Summit Finthor converts unstructured crypto data into actionable insights. It transforms complicated signals into easily understood information that supports more structured trading decisions rather than leaving traders in the dark. Summit Finthor provides users with a trustworthy lens to evaluate the market with greater clarity and reduced uncertainty by accurately identifying patterns.

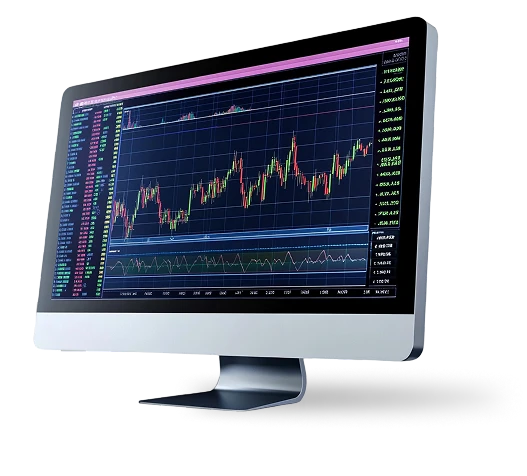

Summit Finthor uses sophisticated AI algorithms to identify significant changes in digital assets. It processes historical and present data to identify emerging trends and display them in an easy-to-understand dashboard format. Without relying on intuition or delayed reactions, these insights enable users to make informed, structured decisions that are grounded in evidence and supported by visual cues.

Users of Summit Finthor can follow strategies based on AI-driven analysis of profitable trading activity. Users can experiment with a tried-and-true strategy based on sound reasoning, rather than speculating about the market's direction or relying entirely on their intuition. Both novice and experienced traders can benefit from these structured assessments.

Summit Finthor maintains confidentiality throughout each analytical request thanks to multiple encryption layers, anonymized data channels, and ongoing penetration testing. Users can browse insights in a secure shell even without placing orders.

Machine-learning pipelines process streaming inputs, allowing Summit Finthor to quickly identify momentum changes and possible price corridors. The markets for cryptocurrencies are highly erratic, and losses are likely. The accuracy of pattern recognition improves with time, becoming more precise with each update.

High security standards and a clean layout allow traders to respond swiftly to new information through interactive visual modules within Summit Finthor that display watchlists, depth charts, and copy-trading recommendations

The rhythm of cryptocurrency markets is interpreted by Summit Finthor using dynamic AI frameworks. Its sophisticated algorithm detects shifts in purchasing and selling trends, providing suggestions based on real-time behaviour analysis. Summit Finthor ensures that each insight accurately represents current conditions, rather than outdated patterns, providing traders with more accurate advice that closely reflects actual market movements.

The cryptocurrency activity is continuously monitored by Summit Finthor. It filters out background noise and identifies significant changes, even during sharp market fluctuations. It assists users in identifying potential entry points without delays or interruptions by continuously scanning and analyzing updates.

Summit Finthor provides a structured experience with professional walkthroughs to cater to all user types. Traders receive clear, straightforward instructions that minimize confusion, covering everything from basic features to advanced functions. By simplifying complexity into manageable steps, the platform focuses on practical clarity, freeing users to concentrate on insights rather than interface challenges.

Summit Finthor analyzes current market activity to identify trend cycles and active trading signals. Its sophisticated system provides traders with timely, organized observations by quickly detecting motion across digital assets. This adaptable engine guarantees seamless usability for users with varying levels of experience and is tuned for continuous market volatility.

Summit Finthor has a responsive guidance module with integrated help features to support each trading step. Users can rely on concise tutorials, troubleshooting prompts, and real-time walkthroughs, whether they are examining platform tools or resolving a question during a session.

Summit Finthor helps users identify significant market changes by converting erratic cryptocurrency trends into organized insight. Its real-time analysis simplifies complicated signals and provides a wide view that allows for precise entry and exit timing refinement.

By decoding unpredictable price behaviors into distinct, actionable patterns, Summit Finthor eliminates the need for guesswork. Traders can react quickly thanks to this alert system, frequently before significant market shifts occur.

Advanced encryption and identity verification are key features of Summit Finthor's security protocols, providing reliable access. With its intelligent tools and user-friendly support, Summit Finthor facilitates informed trading decisions based on reliable data.

Summit Finthor offers structured assessments tailored for both short-term fluctuations and long-term positioning, helping users navigate the rapidity of cryptocurrency trading. Through consistent analysis, it facilitates confident decision-making and helps traders align their strategies with predetermined objectives and expected market behavior.

Through the use of its intelligent algorithms, Summit Finthor provides continuous updates that help adjust trading direction by identifying pertinent data points in real time. Through more informed decision-making, users can improve performance by accurately adjusting plans thanks to these developing insights.

Markets change at varying rates. By displaying the two styles side by side, Summit Finthor facilitates easier comparison of extended strategies and short-burst momentum.

By monitoring real-time liquidity zones, Summit Finthor helps traders assess how easily assets move in the current market environment. The platform supports more intelligent positioning by highlighting times when the market is flexible or constrained by identifying activity clusters and volume levels. This increases awareness of trade timing and price stability.

By emphasizing realistic entry and exit targets, Summit Finthor helps users plan risk within predetermined boundaries. Traders are able to map strategies around their personal comfort zones by using tools that convert price signals into meaningful thresholds. Risk planning is more consistent thanks to this structured guidance, particularly in situations that change frequently.

Summit Finthor assists in maintaining trading in line with predetermined objectives through sophisticated tracking systems. Users receive filtered data insights to inform each decision rather than an emotional response. Even in the face of unanticipated volatility spikes, its AI structure fosters discipline and enables more rational thought and measured execution.

Summit Finthor provides users with technical analysis tools like the Stochastic Oscillator, Fibonacci ranges, and MACD. These tools are used to monitor price signals and determine potential market pivots and momentum-building points.

Each tool makes a distinct contribution: the Stochastic Oscillator indicates overbought or oversold zones, the Fibonacci charts retracement points, and the MACD shows the strength of trends.

Together, they offer structured insight through Summit Finthor that facilitates confident, transparent decision-making in unstable crypto environments.

Summit Finthor looks for emotional patterns influencing the behavior of cryptocurrency prices by scanning real-time digital content, including trader reactions and market updates. This sentiment data provides an early indication of changing momentum, showing whether optimism is increasing or caution is spreading.

To detect changes in investor mood, its AI sentiment engine analyzes enormous amounts of data. Summit Finthor helps identify trend reversals and new confidence levels by detecting subtle emotional patterns. Corrections may loom when fear grows, and surges frequently follow when confidence grows.

Summit Finthor combines sentiment readings with analytical metrics to provide more in-depth context. This combined perspective encourages more logical decision-making by illustrating the interplay between logic and emotion in the current market context.

Summit Finthor simplifies how macroeconomic factors, such as inflation, job data, and interest rates, impact crypto markets, illustrating how external forces influence sentiment and price trends.

It also keeps an eye on how changes to taxes, rules, and policies are being felt. Summit Finthor helps users predict potential market reactions by analyzing the impact of previous announcements on volatility. When managing changes brought on by policy, this predictive perspective promotes preparedness.

By recognizing patterns intelligently, Summit Finthor converts complicated global data into strategic insights. It enables users to plan with foresight for both short-term responses and long-term positioning by connecting significant economic developments to anticipated cybersecurity impacts.

Summit Finthor analyses short-term shifts, breakout activity, and resistance levels to determine high-potential entry and exit points. Users can more clearly time their trades thanks to its machine-learning framework, which converts complicated market movements into actionable signals.

Real-time evaluation of support levels and momentum trends provides traders with accurate signals supported by real-time market data. Summit Finthor enhances decision-making in dynamic environments and increases execution accuracy with this timely intelligence.

Spreading your bets across several crypto markets lessens your exposure to unexpected losses. By providing structured comparisons across asset classes, Summit Finthor helps traders identify the responses of various crypto groups to diverse circumstances. This method encourages more stable and well-rounded portfolio planning.

Summit Finthor keeps an eye on the subtle signals that often precede a market reversal. By scanning key indicators and slight shifts in trend behavior, you get an early heads-up, so you can make more innovative moves before the market catches on.

When momentum changes direction, Summit Finthor responds instantly. It pairs sudden moves with volume checks, helping you catch breakout opportunities early and react with confidence.

During high-stress market moments, Summit Finthor helps you cut through the chaos. It highlights patterns behind sudden moves and provides clarity, so you can stay focused and make calm, strategic decisions.

Summit Finthor guides users through intricate crypto environments by combining structured trading intelligence with cutting-edge AI systems. Through the removal of background market noise and the analysis of extensive data, the platform identifies opportunities in real-time with accuracy and precision.

Continuous data processing enables Summit Finthor to quickly adjust and provide timely updates that accurately reflect the current state of affairs. This combination of astute reasoning and valuable insights facilitates dependable execution, enabling traders to move through fluctuating markets more consistently and with better timing.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |